Check out the final part of my interview with Nexage CEO, Ernie Cormier. We continue our discussion with how the mobile advertising industry is changing and how Nexage is weathering the storm.

Don’t miss part I or part II of this interview with Nexage CEO. Let’s jump right back in:

Andrew: I totally agree with you that this industry is changing very rapidly, even in the online advertising sector. Can you talk about some of the changes you’re seeing and how you are responding?

Ernie: Sure. If you look at things in the mobile world, it’s similar to what was happening online in the late 1990’s when there were no standards and multiple browsers, kind of like the wild wild west. Compare that to the mobile world right now and it makes that seem like a pretty calm sea. The reason for that is the fragmentation of platforms on the handset side and no standardization across platforms. There are even different browsers from platform to platform and publishers have a real challenge managing that complexity. Part of what we bring to the publishers in value is removing significant layers of that complexity by managing those layers.

As far as the ecosystem evolution is concerned, I use the table metaphor. Think about the advertisers on one side of the table and publishers on the other. Those who try to straddle the table, live on both sides, and make money off both sides are already in danger. We’ve already seen many of them scramble to try and rebuild or redefine their business model in order to get on one side or the other. DSPs, demand side platforms, are growing online quickly and starting to make their way to mobile as well.

Real time bidding and other innovative ways for advertisers to price and value inventory and make real time decisions are coming. Other companies are doing things like audience buying, targeting, and segmentation, all of which is moving online. The guys in the middle who are straddling both sides of the table are really struggling. Their very business model is in danger. Exchanges, which are still small in the online market and tiny in the mobile market, are going to endanger those middle guys. So if I was to rank in order the pieces of ecosystem that are in danger, that would be #1.

On the publisher side, the evolution of the ecosystem really depends on what kind of publisher you are. If you’re a premium publisher, you have to worry about audience buying, someone being able to reach your audience outside of your context, or reach the same audience at a lower price. You also have the problem of the perceived value of context declining. I don’t necessarily agree that it should be declining, but that’s the perceived value. Part of what we are trying to do is give publishers the tools so that they can fight that decline and get that value back. We’ll be announcing some work later this year that helps with this.

If you broaden the ecosystem analysis to beyond just advertising, on the application side you start getting into the challenges of discovery and merchandising. It was one thing to find the cool apps when there were only 5,000 apps in the app store, but now it is getting to the point where the merchandising and discovery mechanisms in the app store are basically dis-functional and certainly not working for the broader development community. So within the coming months you will see the developers starting to react and find other ways to reach the customer. How does the consumer find an app when there are 250,000 of them sitting out there?

I don’t care if you’re Macy’s, Nieman Marcus, or Apple, you’re going to have a problem merchandising that. That affects our customers in term of their ability to monetize as well. That will put pressure on them to deliver advertising that is compelling and has a good user experience, which is part of what we are doing. We’re moving forward on supporting rich media and some other things that we think will help them fight the fight as that gets more and more complex.

Andrew: You mentioned Apple, so let’s shift gear to Apple and Google for a minute. Obviously, within the last 9 months they have acquired two of the big players in mobile advertising. How do you view this and what do you think about these acquisitions?

Ernie: We’re thrilled to death because we think that they’ve set a really good valuation point that we’re happy to be measured against when we get to that point in our maturity. I think AdMob, if I remember correctly, was at about 8 or 10 million impressions per month when they were acquired. We are not that far away from that. Again, if you go back to the ecosystem point, we think the ecosystem is evolving awayfrom the idea of a pure ad network. Again I’m not trying to slam AdMob or Quattro – they are both very important partners of ours and we work with them very closely, but we think they lit a fire and brought a lot of attention to the mobile advertising space that otherwise may not have come, and it has been nothing but good for us in that respect. As we mentioned earlier we are getting a lot of interest on the investor side for our Series B and I think it’s pretty safe to say if the AdMob and Quattro acquisitions hadn’t have happened, we wouldn’t be seeing the level of interest that we’re seeing today.

Andrew: In regards to Apple, my understanding of the new developer terms of service is that it shouldn’t affect you at all, right?

Ernie: Yes and no. It won’t directly. As you know, so far anyway, Apple does not seem to be holding the industry to the letter of the law of the TOS. They have continued to let Ad Mob serve ads on the platform. But of course that could change at any point. The letter of the law does not affect us, but as you know, it does affect you if you’re a competitor to Apple. Since we are not a competitor to Apple, and we are a pure play, there is no issue. It does change the M&A market landscape a little bit. But frankly as I’ve thought about whomight be a potential acquirer for us, it’s a very broad list and includes far more than the pure tech plays, the OEM handset players, and the carriers. There’s a lot of things that we’re working on so it’s hard to talk about but I think that will make us very interesting to entire other sectors that are maybe looking to extend their value into mobile.

So in absolute terms – I’m not going to try and duck it – the TOS terms does make it a little more complex for some potential acquirers but for us, the acquirer list is still a very strong and rich list.

A very special thanks to Nexage CEO Ernie Cormier and PR Manager Deb Payson for their time and help with this interview.

My Take:

So what’s the future for Nexage? Only time will tell. But they look like a solid player. Here’s why:

1. Mobile advertising is a rapidly growing and transforming industry. There’s still plenty of blue ocean out there.

2. Nexage is not an ad network. Nexage is a mediation platform that’s designed to increase the value of publisher and app developer advertising real estate. This unique position in the industry is a compelling competitive advantage.

3. Apple and Google are the 800 pound gorillas in the room. They can change the rules of the game at will, but appear to be focused on one another.

4. If web advertising is an accurate indicator, mobile advertising is not likely a winner-takes-all industry since no one can fill 100% of ad requests. Things are changing so quickly that it could be years before there’s a clear set of winners in this space.

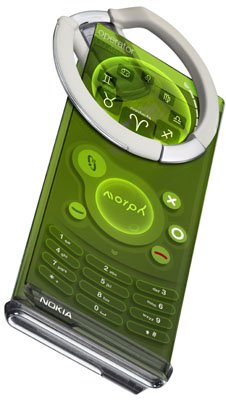

5. Future venture fund-raising for Nexage looks solid becasue they’re already venture backed but an exit is less clear. There are some very interesting strategic partners out there but, Apple’s new developer TOS shrinks the list of potential strategic partners since third-party mobile OS developers (Microsoft, Nokia, HP) won’t acquire Nexage now.

[Originally published By Andrew Bellay on aonetwork.com]